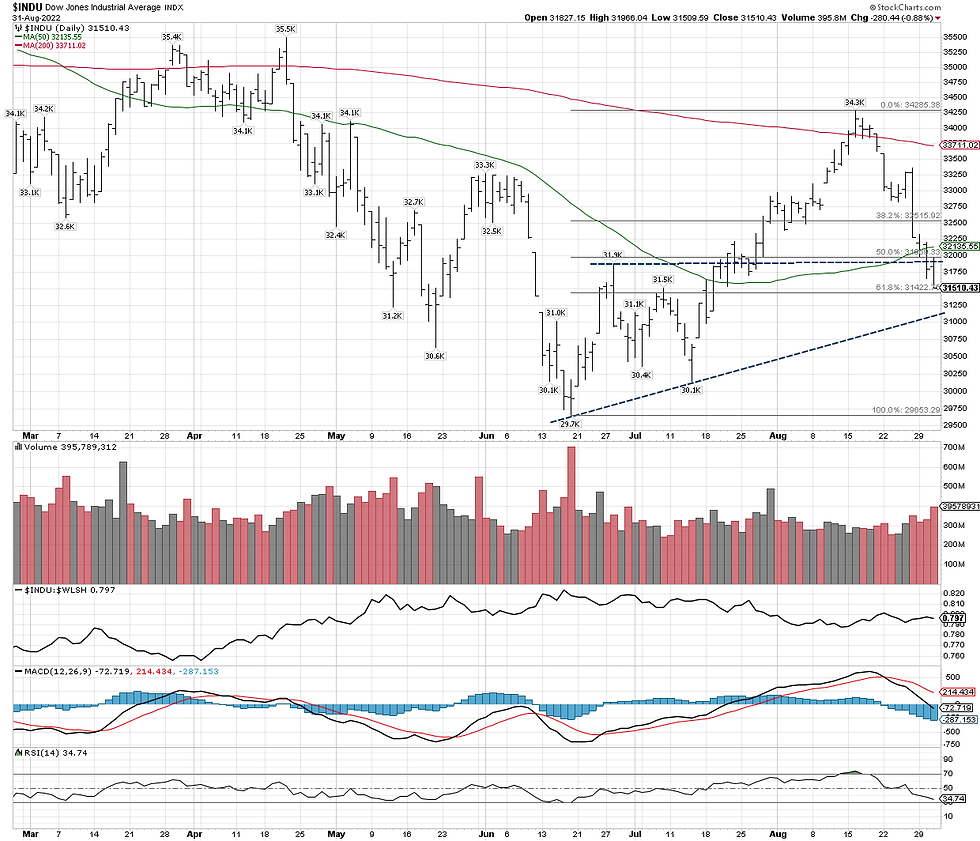

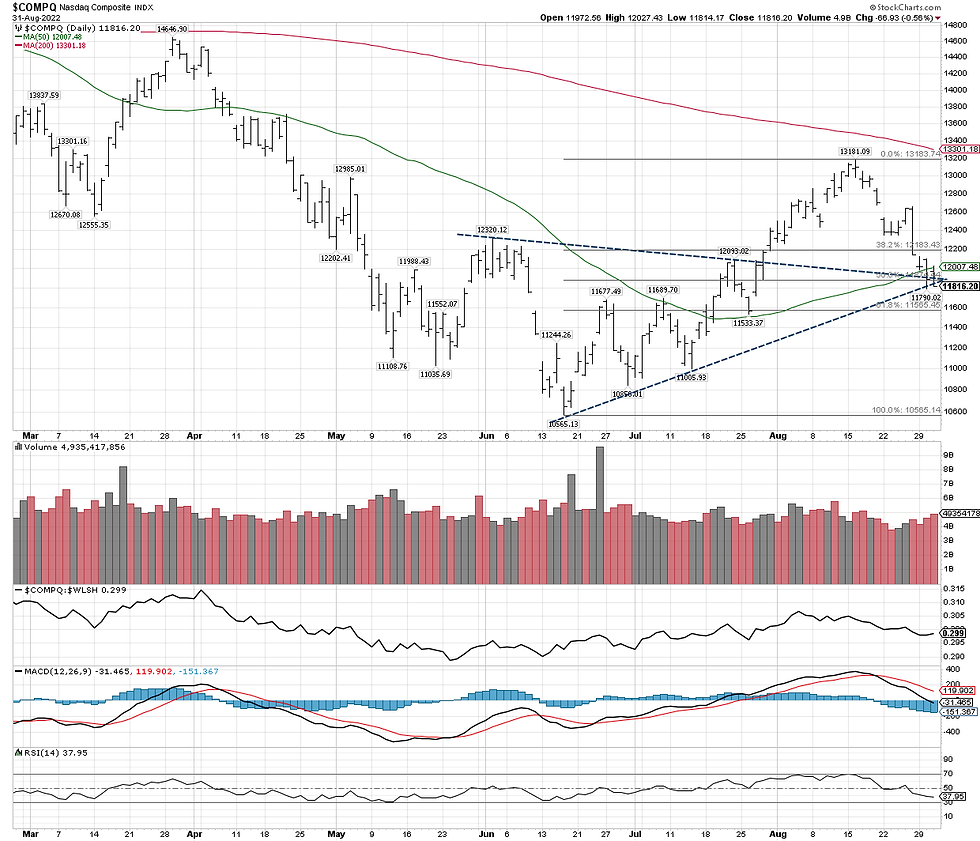

Markets near crossroads as popular indexes such as SPX, INDU, NYA, COMPQ, and NDX have broken their respective 50-day moving averages and are nearing pivotal support. The breakdowns warn of the resumption of the primary November 2021/January 2022 downtrends.

However, two markets have retained their 50-day moving averages during the broad market downturn. Surprisingly it is the Small-Caps, as represented by the Russell 2000 Index (IWM), and the Mid-caps, as represented by the S&P 400 Mid-cap Index (MID).

Although IWM and MID can still violate their 50-day moving average, they have fared better than their peers.

So, what does this mean, if any?

Small-to-mid-cap stocks tend to be more volatile, have higher risk/reward, and are less stable than the Large-caps. They will decline more than their larger cap peers during bear trends. But will also perform better during bull trends.

2022 has been a challenging year for stocks, as evidenced by the primary downtrends since the beginning of the year.

Interestingly, the year-to-date performances between SPX and IWM are almost the same. SPX has declined 17.5%, and IWM has fallen 18%. The 50 basis-point differentials between the two markets are minor based on the higher volatility and risk from the small-caps.

Why the small spread differential between the two contrasting markets?

If the stock market is entering a prolonged bear market (i.e., structural bear), small caps should severely underperform the large caps.

Small caps may already be pricing in high inflation. Historically, because of their smaller size, small caps can react faster than large caps, allowing them to adjust quickly in a climate of tighter liquidity and aggressive Fed monetary policies.

By the same token small caps tend to outperform their larger counterparts in a rising interest rate environment. As interest rates climbed, technology and growth names are the biggest losers.

If the stock market has already discounted a mild recession, small-cap stocks can lead the broader market from a major market bottom.

No one knows if the June 2022 low is indeed the market bottom. In hindsight, we will know months, quarters, and years from now.

In the meantime, we will search for unusual discrepancies and divergences in financial markets to alert us to pivotal turns in the marketplace.

One final thought. Historically, it is reasonable to expect small caps to lead the market from the depths of a market bottom. After all, high risk also translates to high reward.

Comments