Market Reaction to FOMC News

- Peter Lee

- Jun 17, 2021

- 2 min read

Another FOMC meeting occurred yesterday. As can be expected, investors focused on the statements coming from FED Chairman Powell. Although Powell has moved up the guidance of the next rate hike to the end of 2023 from the previous guidance of no rate hikes before 2024, investors continue to fear rising inflation and the next FED rate hike.

Does this imply inflation is around the corner?

It is simply not wise to ignore the messaging from the FED and Chairman Powell. However, it is also ill-advised to ignore the market actions of equities, fixed income, and commodities as these asset classes are leading indicators of economic cycles. Yesterday's trading activities were quite revealing.

The bond market's reaction to the FOMC news came in line with market expectation, as the 10-year US Treasury yields (TNX – 1.511%) jumped sharply higher soon after the news announcement. TNX closed the day with gains of 0.07 or 4.67%. It would appear there were a lot of sellers of Treasuries yesterday. Today, TNX quickly reversed direction, falling 3.70%, suggesting a lot of buyers of Treasuries.

Gold (GLD), an excellent hedge against rising inflation, should have rallied sharply higher in an inflationary environment. However, the commodity plummeted soon after the FOMC announcement, losing 1.69% of its value by the end of the day. The selling continued today as GLD declined another 3.07%.

Yesterday's market action in the equities market was also interesting.

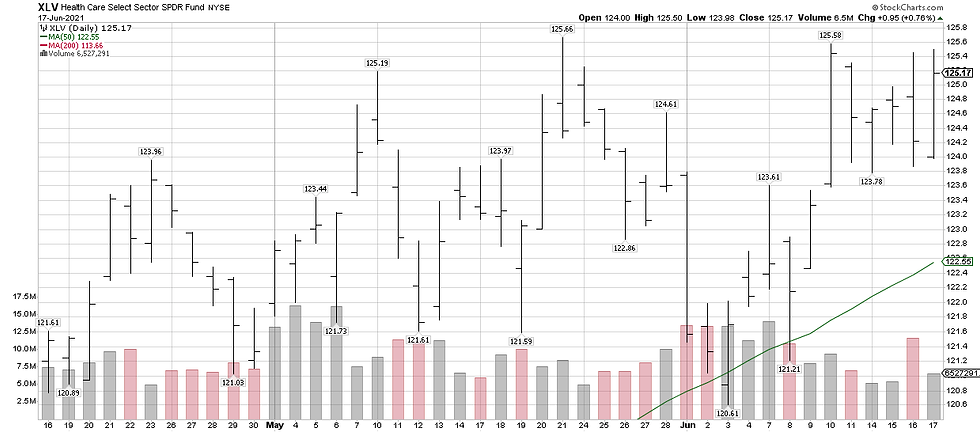

Most defensive related S&P 500 sectors sold off sharply into the close. For instance, S&P Utilities (XLU -1.50%), Consumer Staples (XLP -1.41%), Real Estate (XLRE -0.91%), and Healthcare (XLV -0.38%).

With the sharp rise in yields yesterday, the Financial (XLF +0.11%) and the KBW Bank Index (BKX +0.54%) rose modestly higher. However, today XLF reversed sharply lower, losing 2.96%, and BKX declined 4.90%.

S&P Technology (XLK), Nasdaq Composite Index (COMPQ -0.24%), and S&P Growth Index (SGX -0.38%) declined sharply to intra-day lows but managed to make up the bulk of their losses into the close. Today, the technology and growth sectors rebounded strongly. XLK jumped 1.16%, SGX rallied 1.07%, and COMPQ returned +0.87%.

In summary, there remain widespread concerns about rising inflation and rate hikes. Based on the market reactions to the FOMC announcement, it did not appear Wall Street was fearful, at least over the past two days. We recognize two days do not make a trend. However, if the above trends sustain over the next few weeks or months, then fears of rising inflation may begin to subside, and the FED's call on inflation being transitory will gain traction.

Comments